S&P 500 - MARKET NEUTRAL

S&P 500 - MARKET NEUTRAL we believe to be our key strategy on S&P 500: limited drawdown and stable double digit income.

S&P 500 - MARKET NEUTRAL is a market neutral strategy managed by the team of World Broker (proprietary capital), the strategy is able to perform well in any market condition:

Bull or Bear Market, Low or High Volatility and Trading Range.

Instrument traded: The strategy invest exclusively on S&P 500 index futures and options.

Strategy performance: The strategy is managed actively on a daily basis with a strict risk management. The goal is to achieve a positive performance every year, without a year in loss.

The estimated performance of this strategy is around 15-20% per year based on our past year real track records.

In 2022 we optimised our strategy with an optimal take profit of our positions, these optimisation increased in 2022 our returns at +23.58% in just 12 months. We guess so that for 2023 and year to come our goal and average can be increased as estimates from a range of 15-20% per year at a new range of 20-25%.

Strategy DrawDown: The maximum drawdown from a "PEAK" of our strategy since 2020 inception is below 10%.

Even if past performance cannot be a guarantee for the future performances, we have many reason to think that even in the future the maximum drawdowns we could naturally expect from our positions is around 10% or less and never above 20% (hard stop).

Strategy Inception (Launch): 2021

NAV (Net Asset Value): 1000

PAUM (Proprietary Assets Under Management): 5.000.000 EUR

GROSS PERFORMANCE BEFORE 20% PERFORMANCE FEE

2021-2022 Performance (12 months) : +14.54%

2022-2023 Performance (12 months) : +23.58%

2023-2024 Performance ( 4 months): +9.22%

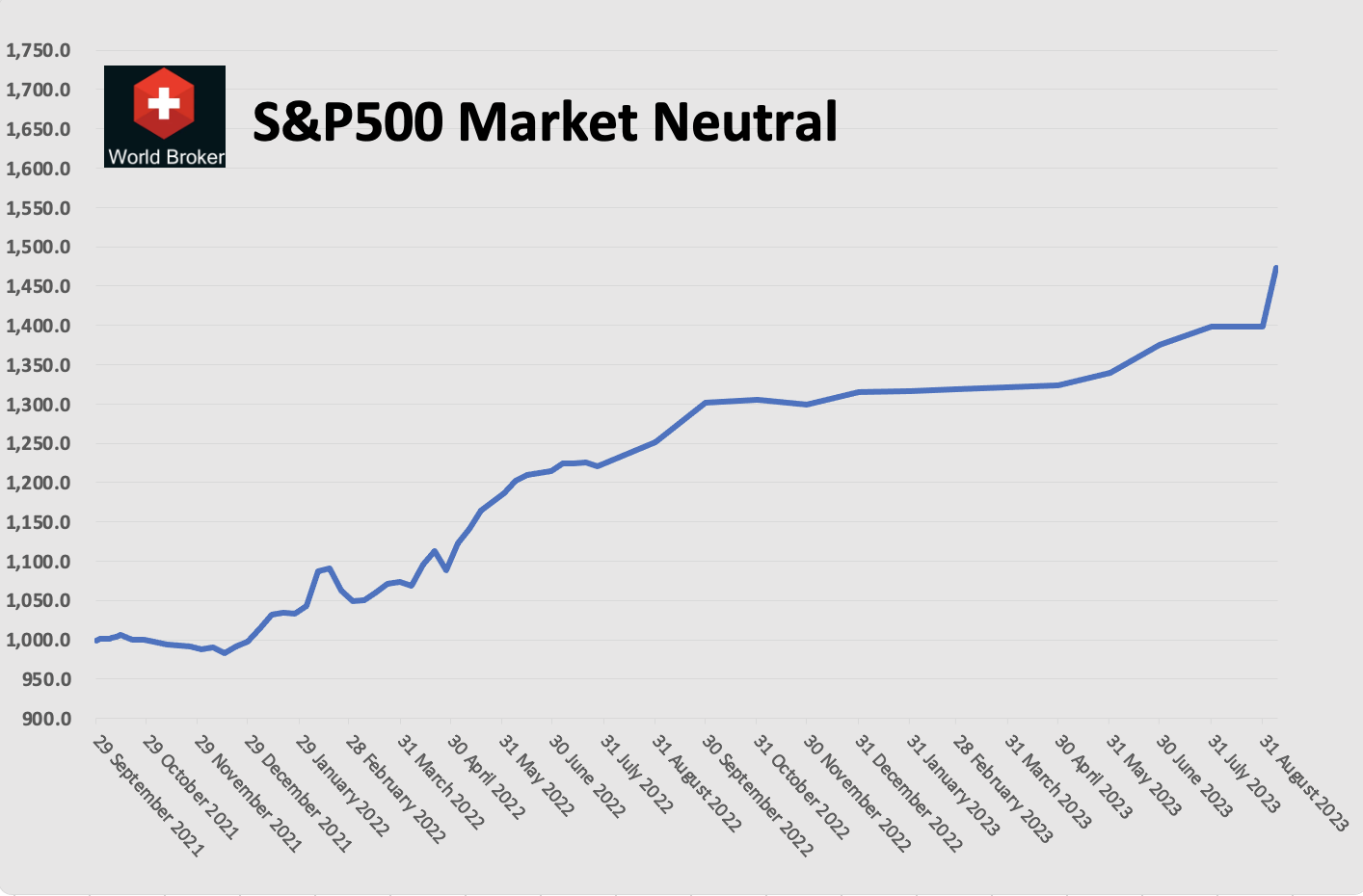

NET PERFORMANCE since launch (30 september 2021): +47.34%

ALL TIME PEAK NAV: 1473.4

CURRENT NAV (4 august 2023): 1473.4

YEARLY PERFORMANCE (2021/2022 full years): +19.06% PER YEAR

S&P500 - MARKET NEUTRAL (Performance Chart)

For any collaboration or subscriptions of signal service (if available)

Please write us to info@worldbroker.com

About:

Proprietary Software: The Team of World Broker developed its own software (in the photo below) to analyze S&P 500, Nasdaq 100, Dax and Euro Stoxx futures and options market. We are able to identify how the market makers or investors are moving or positioning in the market and from that we have a clear idea of which is the direction of the market and we can take advantage of that, and even in the case of a mistake in a trade or direction, we are able to hedge our trade to minimise stop losses and increase our profits.

Our sophisticated technical analysis is unique, we do not trade classic support or resistances but we trade what the market is doing at the right time and at the right level, something you can't know before it happen and that can be only possible with a strict realtime monitoring and risk management you can achieve. Our performance speak clearly.

Furthermore we manage our trades and positions directly from our software and send to any broker we use via API. This give us again the flexibility to collaborate with any major partner could be interested to diversify in us as portfolio managers.

ACCOUNT OPENING (Limited):

Accounts are held at StoneX a Futures Commissions Merchant (FCM) regulated in the U.S. and at an italian major bank.

We limit the account opening to one or few only qualified institutional investors and/or partners till the launch of our fund by end of 2022 / early 2023 (our final product, the fund).

Disclaimer:

This website does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation of any security or any other product or service by World Broker Advisors or any other third party regardless of whether such security, product or service is referenced in this brochure. Furthermore, nothing in this website is intended to provide tax, legal, or investment advice and nothing in this website should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. World Broker Advisors does not represent that the securities, products, or services discussed in this website are suitable for any particular investor. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your personal investment objectives, financial circumstances and risk tolerance. You should consult your business advisor, attorney, or tax and accounting advisor regarding your specific business, legal or tax situation.

World Broker does not endorse any third party sites or links, unless specifically stated by WB. Links to WB from a third party website should not be considered an endorsement by WB or any of its employees. The products and services offered on a third party website linked to WB are not offered or owned by WB unless indicated, and WB cannot attest to the accuracy of information provided by these third party websites. When advertising on third party websites, WB will not be responsible for the content of other advertisers or the content of the third party website.

© World Broker